The relentless upward momentum of Bitcoin shows no signs of slowing down, propelling the cost of holding leveraged bullish positions in perpetual futures to unprecedented heights and creating a compelling opportunity for astute traders.

Bitcoin’s Unstoppable Surge

Bitcoin soared to nearly $57,000 early Tuesday, marking its highest level since late 2021 and extending its year-to-date gain to an impressive 32%, according to CoinDesk data. Concurrently, the CoinDesk 20 index, a comprehensive market indicator, surged by nearly 6%.

Escalation of Funding Rates

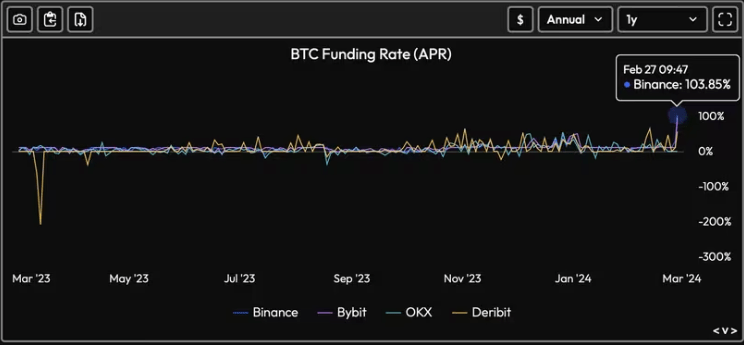

The annualized funding rate for Bitcoin perpetual futures listed on leading exchanges such as Binance, Bybit, and Deribit has skyrocketed, with rates exceeding 100% on Binance, 95% on Bybit, and 56% on Deribit, as reported by data sources Velo Data and CoinGlass.

Woman Identified as Augusta University Nursing Student Found Dead on UGA Campus

Understanding Funding Rates

Perpetual futures, which do not have an expiry date, utilize funding rates to ensure alignment with spot prices. A positive funding rate indicates that perpetuals are trading at a premium to the spot price, requiring long position holders to pay a fee to short position holders. This mechanism, adjusted every eight hours, reflects market sentiment and leverage dynamics.

Insights from Market Observers

Markus Thielen, founder of 10X Research, attributes the surge in funding rates to traders’ bullish speculation fueled by anticipated inflows into U.S.-based spot ETFs. Thielen highlights the growing confidence among traders regarding the positive impact of halving events and ETF inflows on Bitcoin’s price trajectory.

Arbitrage Opportunities Abound

The surge in funding rates presents a lucrative opportunity for non-directional traders and arbitrageurs. By capitalizing on the significant premium of perpetual futures over spot prices, arbitrageurs can profitably execute short positions in perpetual futures while simultaneously purchasing Bitcoin in the spot market, thereby exploiting price differentials and mitigating volatility risks.

Conclusion

As Bitcoin continues its meteoric ascent, fueled by bullish sentiment and market dynamics, savvy traders stand poised to capitalize on the burgeoning opportunities presented by escalating funding rates. Amidst the evolving landscape of cryptocurrency markets, strategic positioning and adept execution enable traders to navigate volatility and unlock potential gains in this dynamic ecosystem.